Supply-Side Trumponomics, Part One: ‘Drill, Baby, Drill’

The day after Donald Trump was confirmed the winner of the 2024 presidential election, the U.S. stock market took off like one of Elon Musk’s rockets. Major stock indices posted gains for the day ranging from 2.5% (S&P 500) to 6% (Russell 2000). The stock market is forward-looking, a mechanism for discounting expected future cash flows into present valuations of companies’ shares.

Clearly the market applauds the election results and is anticipating a return to strong growth and huge investment returns in the second Trump Administration.

Is the hype warranted, or is this just another Wall Street bout of irrational exuberance? Let’s take a look under the hood of the Trump economic program and assess what Trumponomics has in store for the U.S. economy in 2025 and beyond.

Supply-Side Economics

To appreciate Trump’s economic policy program, we need a basic understanding of supply-side economics. In turn, understanding supply-side economics requires a working knowledge of that essential tool of economic analysis, the supply and demand model.

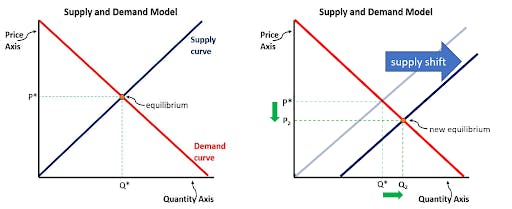

As all first-year econ students know, market “equilibrium” occurs at the intersection of the demand and supply curves. Demand represents the quantity of any product consumers will buy at each possible price. Demand will slope down as consumers buy more of a product when its price declines.

The level of the demand curve will shift up or down based on a number of factors — changes in the number of consumers, shifts in buyers’ incomes, preferences, and expectations, or conditions surrounding related products. Demand for pickup trucks, for example, will shift upward after a prolonged drop in gas prices.

Supply, on the other hand, represents the cost of production for different quantities of any given product. Supply typically slopes up when more “factors of production” — workers, tools, equipment — are required to meet the demand.

As the great economist Thomas Sowell continually reminds us, “Economics is the study of scarce resources which have alternative uses.” To increase production of any one good means pulling resources away from the production of other valuable goods. In a market economy, these resources must be “bid up” in price to give their owners sufficient incentive to redeploy them to an alternative productive use. Hence the supply curve — a.k.a. the cost curve — slopes up for most products in the short run. The level of the supply curve is based primarily on factors that alter any business’ costs of production.

When it comes to “cost of production,” economists identify five categories: Technology, taxes, price of inputs, the number of producers and producers’ expectations. If changes in one or more of these factors lead to an increase in costs of production, the supply curve shifts “up and to the left,” and market forces will move the market to a new equilibrium with a higher price and lower quantity produced.

Likewise, if one or more of these factors changes in a way that reduces the costs of production, the supply curve shifts “down and to the right” and the market will move towards a new equilibrium featuring lower prices and larger quantities produced and purchased.

Supply-side economics starts with the simple truth that economic growth and wealth creation ultimately stem from the supply side of markets — the economic situation facing producers of goods and services.

In other words, the recipe for economic growth is to push the supply curve to the right.

When the supply curve for any good or service shifts to the right, the cost of production is reduced, meaning businesses can produce at a lower cost. In a competitive marketplace, lower costs will soon be passed along to consumers in the form of lower prices. Shifting the supply curve to the right leads to a new equilibrium at a lower price and higher quantity of output. When prices fall and quantities rise, we all get richer.

Hence the mantra: the recipe for economic growth is to push supply curves to the right.

Only by pushing supply curves to the right consistently over time can we increase the production (and thus consumption) of goods and services, improve our standard of living, and achieve economic prosperity.

So what can government do to push supply curves to the right? Plenty. Donald Trump — the entrepreneur-turned politician — knows this well and is promising supply curve-shifting policies like never before.

Three policy areas in particular are ripe for large “positive supply shocks” and a rapid return of the U.S. economy to a high-growth, low-inflation situation: Energy production, Taxes, and Regulations.

Energy Production

My personal favorite plank of Trump’s supply-side program is summarized in Trump’s refrain, “Drill, baby, drill.” Indeed, President-elect Trump knows that the economy runs on energy, he knows that reducing energy costs will benefit everyone in a direct and obvious way, and he knows that America is sitting on vast amounts of “liquid gold,” as he so charmingly refers to “America’s yuge oil reserves.” Trump further understands that government can help or hinder American energy through its stance on regulation, permitting, and taxation of energy production.

Trump has promised a 50% reduction in energy costs for Americans by the end of his first year back in office. Elites in both parties probably laugh this off as mere Trumpian rhetorical hype, but it’s economically realistic and very doable.

Here’s why.

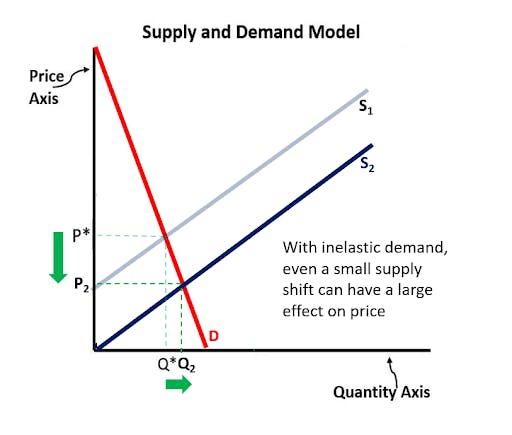

The demand for energy products like gasoline is “inelastic,” meaning the quantity people will buy is not very sensitive to changes in price. If the price of gasoline goes up, most of us will keep on buying gas because we have set patterns of commuting for work, school, and the like. We might be able to trim gas spending by cutting some non-essential trips, but it’s difficult to drastically alter consumption, at least in the near term. Consumers, therefore, have to eat the costs and feel the pain of high energy prices in the form of lower real incomes. On the flip side, if energy prices fall, consumers will not ramp up purchases all that much — they’ll mostly just enjoy the cost savings and expand their purchases of other nice things.

In the big picture, inelastic demand means that when we steadily increase oil and gas production, their prices can fall substantially. We saw this coming out of the recession of 2008, when the perfection of new methods of shale oil production — fracking and directional drilling — led to an explosion of U.S. production.

In the big picture, inelastic demand means that when we steadily increase oil and gas production, their prices can fall substantially. We saw this coming out of the recession of 2008, when the perfection of new methods of shale oil production — fracking and directional drilling — led to an explosion of U.S. production.

Oil prices were initially rising along with the economic recovery, but once the production boom set in and inventories expanded, prices eventually tumbled. Oil prices hovered around $100 in the early 2010s, and then collapsed during 2015, all the way down to the $50-$60 range.

CHECK OUT THE DAILY WIRE HOLIDAY GIFT GUIDE

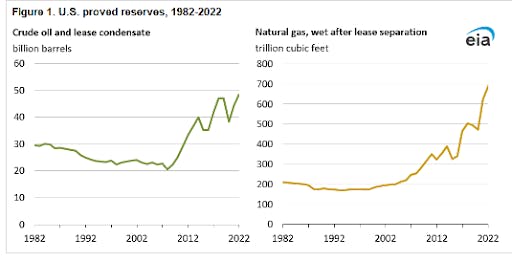

The post-Covid recovery saw another run-up in prices — partly based on demand recovery, but partly due to the overall inflation wrought by the terrible combination of loose monetary policy and massively wasteful government spending via stimulus checks and the Inflation Reduction Act. Even with Biden’s unfriendly regulatory environment, U.S. production of crude oil recently hit an all-time high of 13.4 million barrels per day, and U.S. proved reserves of both oil and natural gas are also at all-time highs.

With Trump’s pro-energy policy mix, oil and gas production is likely to once again take off, with the potential to crush prices, as we saw in the early 1980s and again in the 2010-2015 era.

Source: Federal Reserve Economic Data

Source: U.S. Energy Information Agency

With his cabinet nominations, Donald Trump has shown a serious commitment to “energy dominance.” As governor of the third largest oil and gas state, North Dakota’s Doug Burgum knows the industry well, and as the incoming Secretary of the Interior he will be in a position to greenlight drilling permits on over 500 million acres of federally-managed land — permits that Biden’s cronies either slow-walked or denied outright.

Chris Wright, CEO of Liberty Energy, helped perfect the fracking techniques that vaulted America to the forefront of global energy production. As Energy Secretary, Wright can quickly undo Biden’s moves to hamstring U.S. exports of natural gas.

Lee Zeldin is a former GOP congressman from New York and a strong supporter of American oil and gas. As EPA Administrator, he will be able to mitigate regulations that stifle fossil fuel production and delivery.

Overall, Trump’s picks present a strong and united pro-fossil fuel front. The stage is truly set for an American energy renaissance, the largest piece of Trump’s supply-side economic package.

* * *

Tyler Watts is a professor of economics at Ferris State University in Big Rapids, Michigan.

The views expressed in this piece are those of the author and do not necessarily represent those of The Daily Wire.